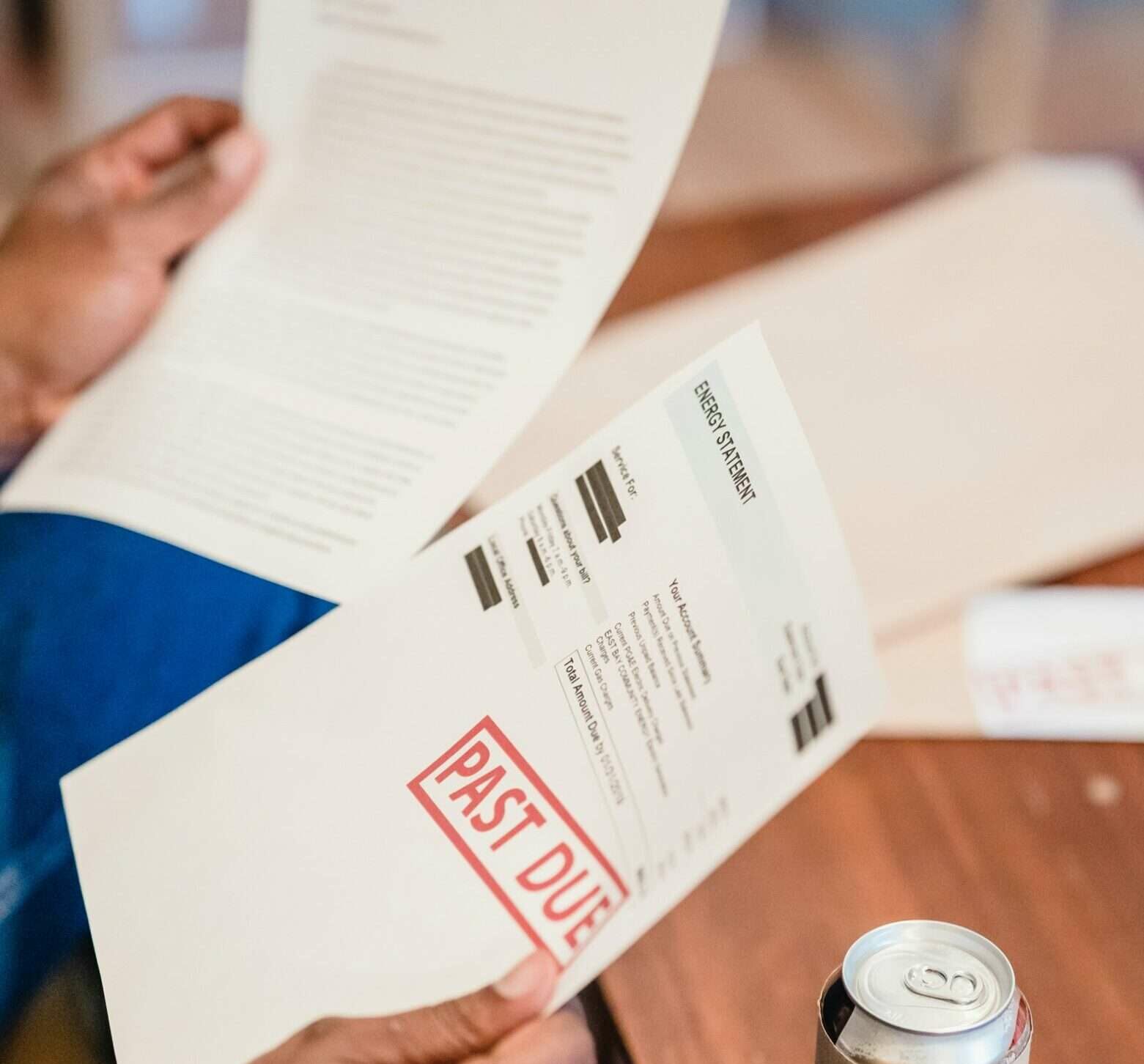

Collecting payments can be challenging for any business. When a customer is delinquent on their payment, it can adversely affect the cash flow of a business and securing money that businesses are owed will become a vexing task. However, having streamlined BPO services in place to manage delinquent payments will help ensure that your customers deal with their payments in a more timely fashion and that companies can write off fewer accounts to bad debt. Here are five tips that help in reducing delinquency rates.

Contents

Communicate Early and Often

You should start communicating with your customers even before they become delinquent on their payments. Reminding your customers on a timely basis but in a restrained and non-intrusive manner about their payment dates will keep them alert about their responsibilities. At FCS, we utilize early intervention strategies as a pre-emptive measure to inform your customers and keep them updated about their payments.

Offer Payment Plans or Payment Options

Customers may not have the resources available to pay off their balance all at once. Offering them payment plans or other payment options such as credit cards may make it easier for them to pay off their debt over time in smaller, more manageable chunks rather than one large lump sum.

Utilize Automated Reminders

Automated reminders sent via email or text message can be very helpful in getting customers to remember when their next payment is due and ensure that they are making timely payments towards their debt. This automated system will also save you time since these reminders can be sent out regularly without any manual effort from you or your staff members.

Hire An Agency That Offers First Party Services

By utilizing the experience and expertise of an agency that offers First Party Services to manage delinquent payments, businesses can free up resources for more important tasks. Agencies offering early intervention services employ omnichannel customer service strategies and AI-enabled contact optimization to help remind debtors of their responsibilities, leading to lower roll rates and improved customer loyalty. Furthermore, they are compliant with the ever-changing legal landscape associated with collection. This greater level of efficacy helps reduce delinquency rates among debtors while ensuring that businesses successfully receive the money they are owed in a timely manner.

Implement Late Fees and Penalties

Implementing late fees and penalties for delinquent payments can encourage customers to pay on time and make sure they understand the consequences of not paying what they owe by a certain deadline. These fees can be applied after a certain number of days past due or after multiple attempts at reaching out have been unsuccessful in getting your customer’s attention, thus motivating them to make timely payments towards their debt(s).

Dealing with delinquent payments does not have to be an overwhelming task if you approach it strategically with a plan in place for managing these situations effectively. First Credit Services (FCS) – A BPO company with over 25 years of experience specializing in compliant First Party Collections and Third Party Collections, is your go-to agency if you’re thinking of outsourcing your collections processes. We have a sophisticated strategy in place that seamlessly integrates with your internal system and engages your delinquent customers as a member of your team.

Following these five simple tips should help make this process easier for both you and your customers so that everyone involved understands how best to move forward toward resolving any outstanding debts owed by either party involved in the transactions.